Solutions

Products

-

Primary mobile crushing plant

-

Independent operating combined mobile crushing station

-

Mobile secondary crushing plant

-

Fine crushing and screening mobile station

-

Fine crushing & washing mobile station

-

Three combinations mobile crushing plant

-

Four combinations mobile crushing plant

-

HGT gyratory crusher

-

C6X series jaw crusher

-

JC series jaw crusher

-

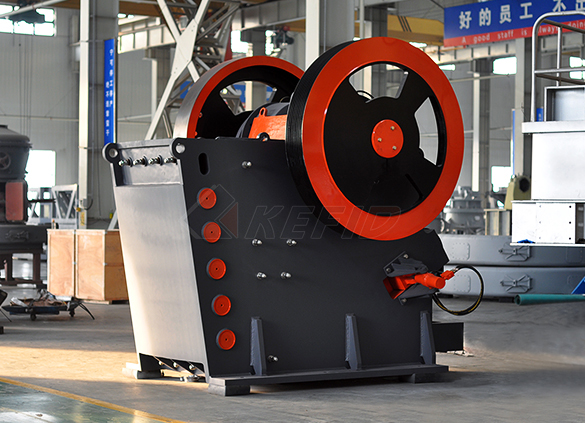

Jaw crusher

-

HJ series jaw crusher

-

CI5X series impact crusher

-

Primary impact crusher

-

Secondary impact crusher

-

Impact crusher

-

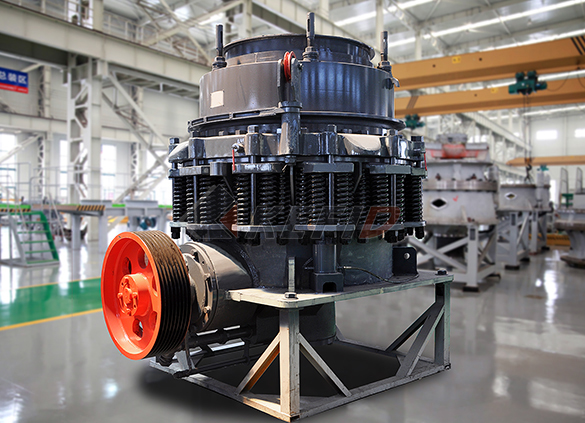

HPT series hydraulic cone crusher

-

HST hydraulic cone crusher

-

CS cone crusher

-

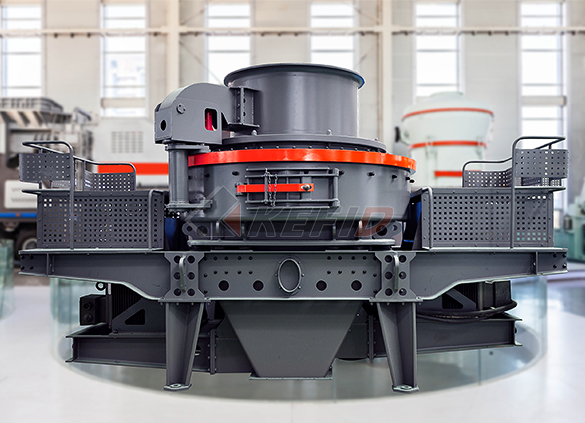

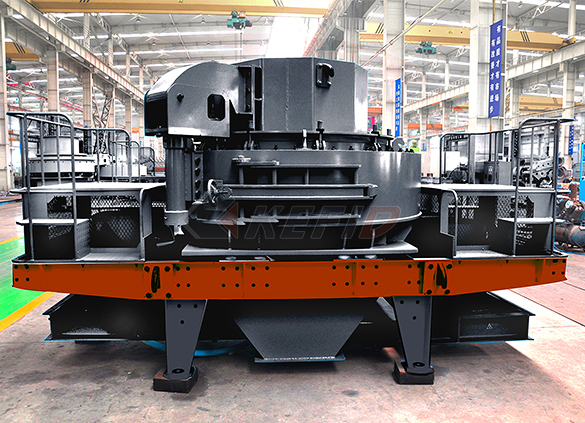

VSI6S vertical shaft impact crusher

-

Deep rotor vsi crusher

-

B series vsi crusher

-

Vertical grinding mill

-

Ultra fine vertical grinding mill

-

MTW european grinding mill

-

MB5X158 pendulum suspension grinding mill

-

Trapezium mill

-

T130X super-fine grinding mill

-

Micro powder mill

-

European hammer mill

-

Raymond mill

-

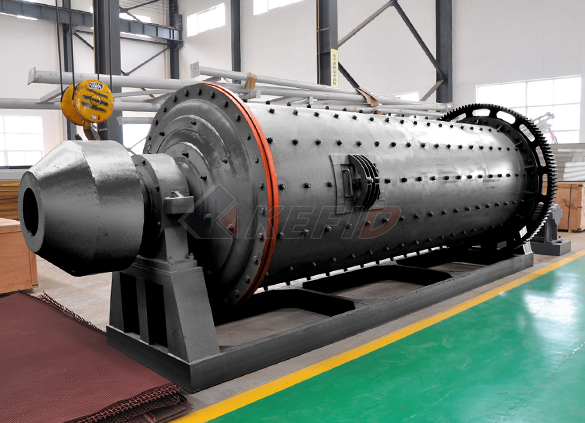

Ball mill

-

GF series feeder

-

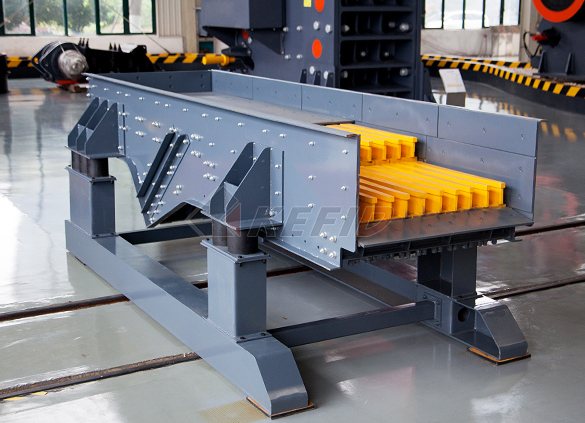

FH heavy vibrating feeder

-

TSW series vibrating feeder

-

Vibrating feeder

-

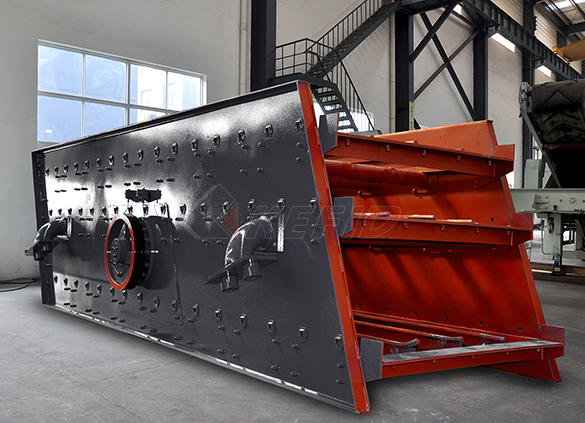

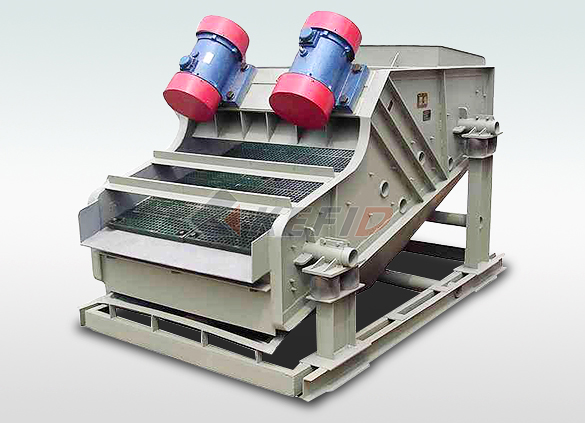

Vibrating screen

-

S5X vibrating screen

-

Belt conveyor

-

Wheel sand washing machine

-

Screw sand washing machine

-

Rod mill

-

Dryer

-

Rotary kiln

-

Wet magnetic separator

-

High gradient magnetic separator

-

Dry magnetic separator

-

Flotation machine

-

Electromagnetic vibrating feeder

-

High frequency screen

Business Partners Limited

Nonfinancial services Our addedvalue services provide an integrated solution for you, catering for all aspects of your business needs These include consulting and mentorship services, offered through a database of highly skilled business and industry specialists, as well as property broking and management services offered through our Property Management Services DivisionMar 08, 2021 A limited partnership (LP) exists when two or more partners go into business together, but the limited partners are only liable up to the amount of their investment An LP is Limited Partnership (LP) DefinitionJul 05, 2020 Some partnerships include individuals who work in the business, while other partnerships may include partners who have limited participation and also limited liability for the business's debts and any lawsuits filed against it 2 A partnership, as opposed to a corporation, is not a separate entity from the individual ownersBusiness Partnership: What Is It?

Limited Partner Definition

Feb 24, 2021 A limited partner, also known as a silent partner, is an investor and not a daytoday manager of the business The limited partner's liability cannot exceed the amount that a Sep 17, 2020 Limited partners have a special tax situation when the partnership has a loss Because they have don't participate in the partnership business, they have what the IRS calls "passive activity" In this case, their share of the partnership's loss for the year may be limitedTypes of Partners in a Partnership BusinessMar 08, 2021 A limited partnership (LP) exists when two or more partners go into business together, but the limited partners are only liable up to the amount of their Limited Partnership (LP) Definition

Business Partnership: What Is It?

Jul 05, 2020 A general partnership (GP) consists of partners who participate in the daytoday operations of the partnership and who have liability as owners for debts and lawsuits; A limited partnership (LP) has one or more general partners who manage the business and retain liability for its decisions and one or more limited partners who don't participate in the operations of the business Apr 23, 2020 2 Limited Partnership (LP) How they’re structured A limited partnership is made up of general and limited partners Both types of partners are entitled to business profits, but have different roles and degrees of liability A limited partnership needs at least one general partner 3 Different Types of Business Partnerships GP, LP, LLPFeb 24, 2021 A limited partner, also known as a silent partner, is an investor and not a daytoday manager of the business The limited partner's liability cannot exceed the amount that a person Limited Partner Definition

The Small Business Partnership: General and Limited

Jul 02, 2019 Limited partners must file a limited partnership certificate that includes the names of all general partners Without such a document filed, even if the intent by all parties is to have general partners who run the business and limited partners who only invest money, the limited partners Sep 17, 2020 Limited partners have a special tax situation when the partnership has a loss Because they have don't participate in the partnership business, they have what the IRS calls "passive activity" In this case, their share of the partnership's loss for the year may be limitedTypes of Partners in a Partnership BusinessLimited liability partnership (LLP) A limited liability partnership (LLP) is a type of partnership where the owners aren’t held personally responsible for the business’s debts and obligations or the actions of other partnersWhat Is a Business Partnership? Which Type of Partnership

4 Types of Partnership in Business Limited, General, More

Limited partnerships are generally very attractive to investors due to the different responsibilities of the general and limited partners Limited liability partnership A limited liability partnership, or LLP, is a type of partnership where owners aren’t held personally responsible for the business’s debts or other partnersLimited partnerships are generally very attractive to investors due to the different responsibilities of the general and limited partners Limited liability partnership A limited liability partnership, or LLP, is a type of partnership where owners aren’t held personally responsible for the business’s debts or other partners4 Types of Partnership in Business Limited, General, MoreFeb 24, 2021 A limited partner, also known as a silent partner, is an investor and not a daytoday manager of the business The limited partner's liability cannot exceed the amount that a person invested in Limited Partner Definition

Business Partnerships: What You Need to Know

Jul 16, 2020 A business partnership can be formed by individuals and/or business entities (eg, limited liability companies or corporations) The terms of the partnership can take many shapes and formsDec 27, 2019 A General partnership has one type of partner, and all participate in the daytoday decisions and the way their partnership share works are the same A Limited partnership has both general partners and limited partners A Limited Liability Partnership allows all partners to be shielded from liability for normal partnership activities How to Start a Partnership in 7 Easy StepsA partnership in which each member has an equal right to manage the business and share in the profits, as well as an equal responsibility for the partnerships debts Limited Partners People who invest in the partnership but don't participate in any day to day managementBusiness Partnership Flashcards Quizlet

How to Get Paid as a General Partner of Limited

Sep 29, 2017 A limited partnership is composed of more than one partner Therefore, as we discussed in a previous post, the business will submit an informational return to the IRS known as a Form 1065Each of the partners will be issued a K1 that will indicate the portion of the profit and loss that the individual will be responsible for claiming on their Schedule E (supplemental income and loss) and Mar 04, 2021 A partnership is the relationship between two or more people to do trade or business Each person contributes money, property, labor or skill, and shares in the profits and losses of the business Publication 541, Partnerships , has information on how to:Partnerships Internal Revenue ServiceMar 01, 2008 Using the valuation of the business as a predicate, the remaining partners might consider the possibility of restructuring the business by inviting a new participant into the business The End of a Business Partnership Entrepreneur

Brookfield Business Partners

Overview Brookfield Business Partners acquires highquality businesses and applies its global investing and operational expertise to create value, with a focus on profitability, sustainable margins and sustainable cash flows It partners closely with management teams to enable business Aug 16, 2016 Business partners, like marital partners, tend to be opposites (in some way) People look for people who fill their gapsthat's sort of the point of finding a "partner"6 Ways to Spot a Bad Business Partner IncOct 28, 2020 Silent partners, on the other hand, are full business partners, even if they don't actually run any part of the business A silent partner is just as responsible for company debts as normal partners Family and friends are typically the first people to be asked for money when someone decides to open a businessHow to Become a Silent Partner in a Business

How to Split Profits in a Small Business Partnership

Mar 05, 2019 Limited Liability Partnerships: Another option is a “limited liability partnership” also known as an LLP Professional partners, such as lawyers or accountants, are often advised to go this route since it protects the business owners from personal liability for the debts or liabilities incurred by the partnershipBusiness Partners (Mauritius) Limited Best Professional Services of the highest standard to every client on a personal levelBusiness Partners (Mauritius) LimitedNov 25, 2019 Any business with more than one owner is considered a partnership Partnerships are not taxed Rather, partnerships require K1 reporting to pass through all income earned to individual partnersHow Are Business Decisions Made in a Partnership?